Economic Focus: Residential Remodeling – The Other Big Driver

Happy New Year to everyone. Hopefully your 2022 is off to a good start and some of the chaos of the past two years will start to calm down a bit!

Many of my past reports have dealt with new housing starts. This is simply because housing starts are the single best predictor for future shipments of domestic hardwood plywood (and Columbia Forest Products’ shipments).

However, we know from experience and survey data that new housing starts are not the only generator of hardwood plywood purchases. Along with smaller do-it-yourself (DIY) projects, professional remodels are another important driver of demand for hardwood plywood.

Unfortunately, while new housing starts data is readily accessible from various government websites, there is not an official government data series regarding remodels and repairs. However, we have two primary means of measuring remodel activity.

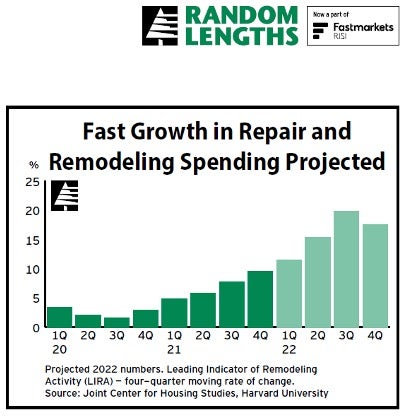

The first is from studies by entities like the National Association of Home Builders (NAHB) which is based on surveys of the organization’s members. However, this data is only collected quarterly (monthly is preferred). The second option is to look at government data for existing home sales, which have proven to be an excellent proxy for remodeling activity.

First, we’ll look at some statistics provided by the John Burns Real Estate Consulting group which published a report in January covering remodel activity.

According to their report, after dipping by about 2% in 2019, total residential building materials spend (includes new starts and repair / remodel) increased 5% and 16% year-over-year (YoY) in 2020 and 2021 respectively. The Burns Group projects this same spending to increase 15% YoY both this year and next year.

On the remodel and repair (R&R) side, the Burns group January report measured total spend increased 11% YoY in 2021. Much of this was driven by small ($1.5-8.5K) and big (>$8.5K) projects, as mini (<$1.5K) projects declined 2% in 2021. The decline in mini projects is likely because so many mini projects (usually done by homeowners themselves) were completed during the “DIY Boom” during the COVID shutdowns, boosted by new “from-home” workers and the stimulus checks.

There was a shift from these smaller projects to larger projects mostly completed by professional remodelers in mid-2021.

Fortunately, all three project types are projected to grow in spend in 2022, with a total projected 9% increase in spend this year vs. 2021. The primary driver for the forecasted growth is the number of single-family homes in the “prime remodel” years—that is, between 20-39 years old. Homes of that age tend to see more spend on R&R activity.

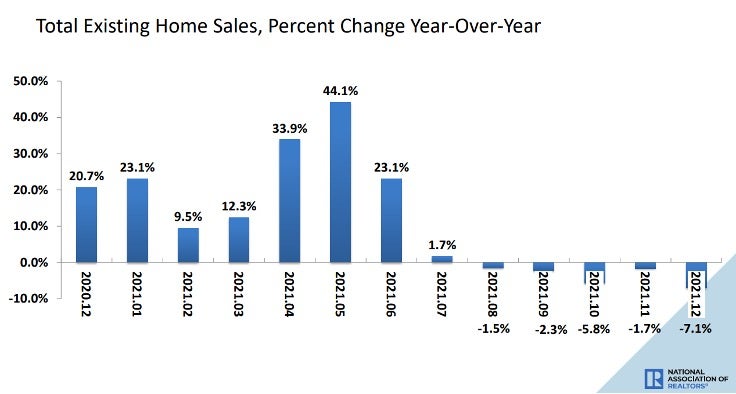

We see a slightly different story on the existing home sales side of the picture. After massive run between December 2020 through July 2021, existing home sales from June through December of last year all experienced YoY decline from the year prior, with December sales down 7.1% YoY.

This may be a bit misleading, given existing home sales were a bit inflated from Q3-2020 through Q2-2021 due to pent-up demand after the COVID shutdowns.

While single-unit housing starts will continue to grow over the next couple years, we will see a slower rate of growth in existing home sales, primarily due to lack of inventory. It’s difficult for homeowners to take advantage of high home prices, given other homes they might buy would be equally expensive.

In addition, the projected growth in R&R spending is in dollars, and existing home sales is in homes (units). The spend includes the recently-higher-priced materials and labor, as increases in spending will outpace increases in the number of homes sold. But not to fear, existing home sales are still growing, just at a lower pace simply due to the extremely low housing inventories.

In the end, the housing and R&R markets are experiencing the same issues as manufacturers of all building materials: demand for housing is outpacing supply (due to labor issues, material shortages, costs, etc.) and demand for building materials also continues to exceed supply (due to the same issues).

While this may be frustrating for builders, would-be-homeowners, manufacturers and their customers, it does help to prevent a bubble, where homes might be overbuilt, resulting in a correction later in time. Better to be under-supplied in housing than massively oversupplied…we’ve been through that before and don’t want to go through that again!

Thank you for reading and I wish you and your loved ones a blessed and safe 2022.